Beyond Hype: Practical Adoption of Blockchain in Insurance

Life is full of surprises and circumstances, some of them make us happy and some drown us in unexpected events. When life throws us with such unexpected events, insurance comes to the rescue, if you have one! Insurance is a risk-mitigating tool, When you buy insurance, you buy protection from the unexpected events life throws at you. Financial loss, distress recovery, health insurance, and many more. Though insurance comes as a hero protecting us from unpredictable events, many people are not interested in buying insurance because of the user experience pain points involved. This guide provides practical insights and tips for the successful adoption of blockchain.

Insurance – Defined

Insurance is not only a risk-mitigating tool that protects you from unforeseen obstacles, it is also the bedrock of any economy and contributes greatly to the economic development of a nation. The premiums people pay for the insurance plan are used in the finance and investments of a nation’s economy thus boosting a country’s GDP.

Why do Insurers need more robust technologies?

The gross premium collected by life insurers in India increased from US$39.7 billion in FY12 to US$89.3 billion in FY22. It is estimated that premiums from India’s life insurance segment will reach US$317.98 billion by FY31 which indirectly means many people are buying premiums from the insurance sector. But is the insurance industry ready with robust technologies to handle massive growth and data handling? No, the insurance companies lie far behind the banking sector in terms of recent technology adoptions. Here are some of the pain points all the insurers globally face.

Pain points in Insurance Industry

- Inaccessible data

Insurance companies lie the LIC of India, the biggest insurance company and the data they are handling is unimaginably huge. Though they are digitizing these data, these data are sensitive and prone to forgery, and sometimes the right data is not available at the right time, which makes disputes among the stakeholders and thus delays the claim process or other authentication processes.

- No Automation

Deloitte’s 2022 insurance industry outlook reports that around 70% of insurance companies are increasing spending on data management tools this year, and 7 4% are investing more in artificial intelligence (AI), which supports automation, among other advantages.

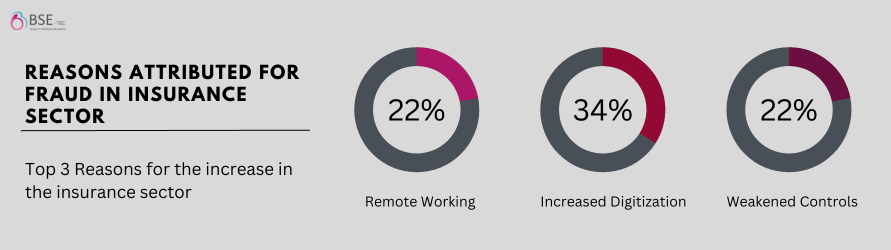

- Frauds and False Claims

Fraud accounted for around 10% of all claims costs, according to the insurance companies and insurance professionals surveyed by FRISS. False exaggerated claims, fabricating false healthcare records, non-existing mediclaims, and filing several claims for one incident are the most common frauds committed in the insurance industry. Another highly common life insurance fraud in India is fake policy fraud where scammers pretending to be life insurance agents offer you a fake policy

- Data Forgery

Insurance companies lose 8.5% of their revenue to fraud, according to PwC. To meet targets, agents may falsify documentation of ineligible clients. There is currently no integrated method in the insurance industry to track and tag an agent for misconduct or fraudulent behaviour.

- Delays in Claims

Lack of standard procedures, large volumes of claims, customer disputes, underwriting, and agreements outlined for new contracts put a dent in the insurance claim process.

How can blockchain help overcome the challenges faced by Insurance companies?

- Data Transparency

Blockchain’s distributed nature and consensus mechanisms provide increased trust and transparency for insurance stakeholders. Policyholders can verify the authenticity and accuracy of their policies, track the status of claims in real time, and have greater visibility into the inner workings of insurance contracts. Insurers, on the other hand, can demonstrate regulatory compliance, reduce disputes through transparent and auditable records, and build trust with customers.

- No False Claims

With digital identities deployed with the help of smart contracts during the Know Your Customer (KYC) process, there is no chance of identity theft. Also, since the smart contracts are deployed in the blockchain, all the data needed are transparent and are updated in real-time. This enables streamlined communication for all the stakeholders involved resulting in reducing the errors and frauds like false claims.

- Data Security

Insurance Companies deal with a massive amount of sensitive customer data. By adopting blockchain, Insurance companies can ensure the security and integrity of this data through cryptographic techniques and decentralized consensus. This helps in preventing unauthorized access, data tampering, and fraud.

- Automation and Faster Payouts

The claims settlement process can be time-consuming and complex. With blockchain, Insurance companies can automate and streamline many manual steps, reducing administrative costs and improving efficiency. Smart contracts can automate claims validation, policy enforcement, and payment disbursement, making the process faster, and transparent, and reducing the chances of disputes.

While the potential benefits of deploying blockchain in insurance are compelling, practical adoption still faces several challenges. These include regulatory uncertainties, scalability concerns, interoperability issues, and the need for industry-wide collaboration. However, as the technology matures, and these challenges are addressed, we can expect to see more widespread adoption of blockchain in the insurance industry, leading to increased efficiency, cost savings, and improved customer experiences. Ready to take your insurance business to the next level with blockchain technology? Get in touch with BSEtec for a free blockchain consultation.

Did you find this article useful? Let us know by leaving a comment below, or join us on Twitter and Facebook.