Cryptocurrency Burn: Fueling the Price of Crypto!

Cryptocurrency burn refers to the deliberate and permanent removal of a certain amount of tokens or coins from circulation. This process is typically executed by sending the tokens to an address or smart contract that has no private key or is otherwise inaccessible, rendering the tokens irretrievable. Burning cryptocurrencies serves various purposes and can have several benefits for the project and its ecosystem.

Reasons for Burning

- Supply Reduction: Burning tokens reduces the total supply, which can increase scarcity and potentially drive up the value of the remaining tokens.

- Economic Incentives: Burning can be used to incentivize token holders by decreasing the circulating supply and rewarding them with increased token value.

- Tokenomics Adjustment: Projects may burn tokens to rebalance or adjust their tokenomics, aligning them with the project’s long-term goals.

- Eliminating Spam or Fraud: Burning tokens can be a preventive measure against spamming, fraudulent activities, or misuse of the tokens.

Benefits of Burning

- Price Appreciation: Decreasing the token supply can increase demand and potentially lead to price appreciation, benefiting token holders.

- Market Confidence: Token burns can create a positive perception among investors, signaling that the project team is committed to managing the token supply effectively.

- Economic Efficiency: Burning tokens can eliminate unnecessary or redundant supply, optimizing the overall economic efficiency of the cryptocurrency.

3. Statistics and Examples:

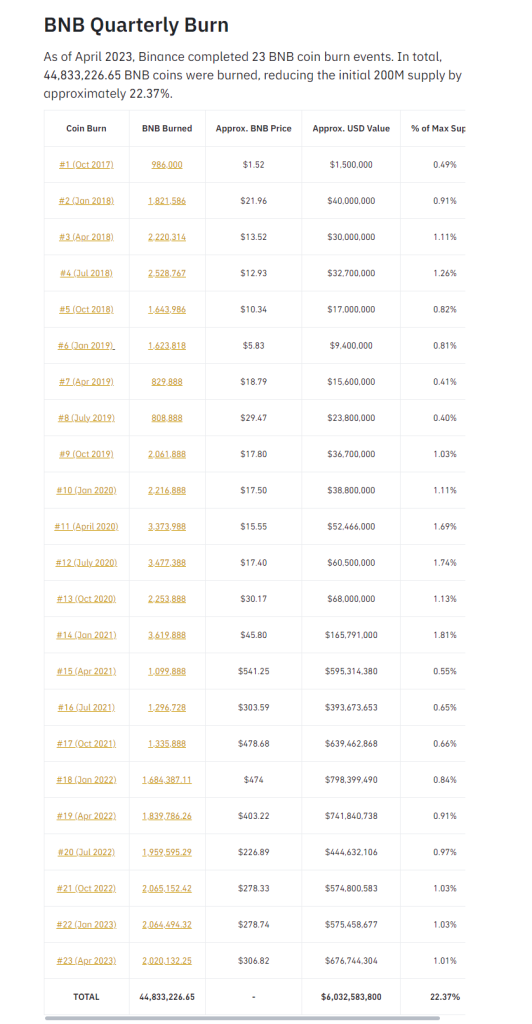

Binance Coin (BNB): Binance, one of the largest cryptocurrency exchanges, periodically burns BNB tokens. Here are statistics on how Binance value has appreciated over a period of burns starting from 2017.

4. Entities Involved in Burning:

- Project Teams: Cryptocurrency projects themselves often initiate token burns. They have control over the token supply and can choose to burn tokens as part of their development and growth strategies.

- Exchanges: Some exchanges implement token-burning mechanisms as part of their token listing or trading processes. This may involve using a portion of trading fees to buy and burn their native exchange tokens, reducing the overall supply.

- Community: In some cases, token burning can be initiated by community voting or consensus, allowing token holders to participate in the decision-making process.

5. Burning Methods:

- Public Address: Tokens are sent to a publicly known address, which is typically unobtainable or has no private key associated with it.

- Smart Contracts: Tokens are sent to a smart contract with predefined conditions that prevent anyone from accessing or retrieving the tokens.

Note: It’s important to note that the specifics of token burns can vary between different cryptocurrencies and projects. It’s advisable to refer to the official documentation or announcements of a particular cryptocurrency to get accurate and up-to-date information regarding token burns.

Did you find this article useful? Let us know by leaving a comment below, or join us on Twitter and Facebook.